Introduction – Research and development tax expenditures and credits The rules regarding SR&ED claims are set out in various parts of the tax act. Section 37 allows for the deduction of SR&ED expenditures while section 127 allows for taxpayers to claim ITCs for SR&ED. Through amendments in 1944 to...

In The University of New Brunswick v. The Minister of National Revenue, 2023 TCC 72, (U.N.B v. M.N.R) the University of New Brunswick (the “University”), appealed a decision of the Canada Revenue Agency (“CRA”), that classified a post-doctoral fellow (“post-doc fellow”) as an employee of the University. The CRA...

Introduction: The General Anti-Avoidance Rule & Documentary Discovery during Tax Litigation Section 245 of Canada’s Income Tax Act contains the general anti-avoidance rule (also known as the “GAAR”). The GAAR aims to prevent taxpayers from enjoying tax benefits by invoking avoidance transactions that misuse or abuse specific provisions of...

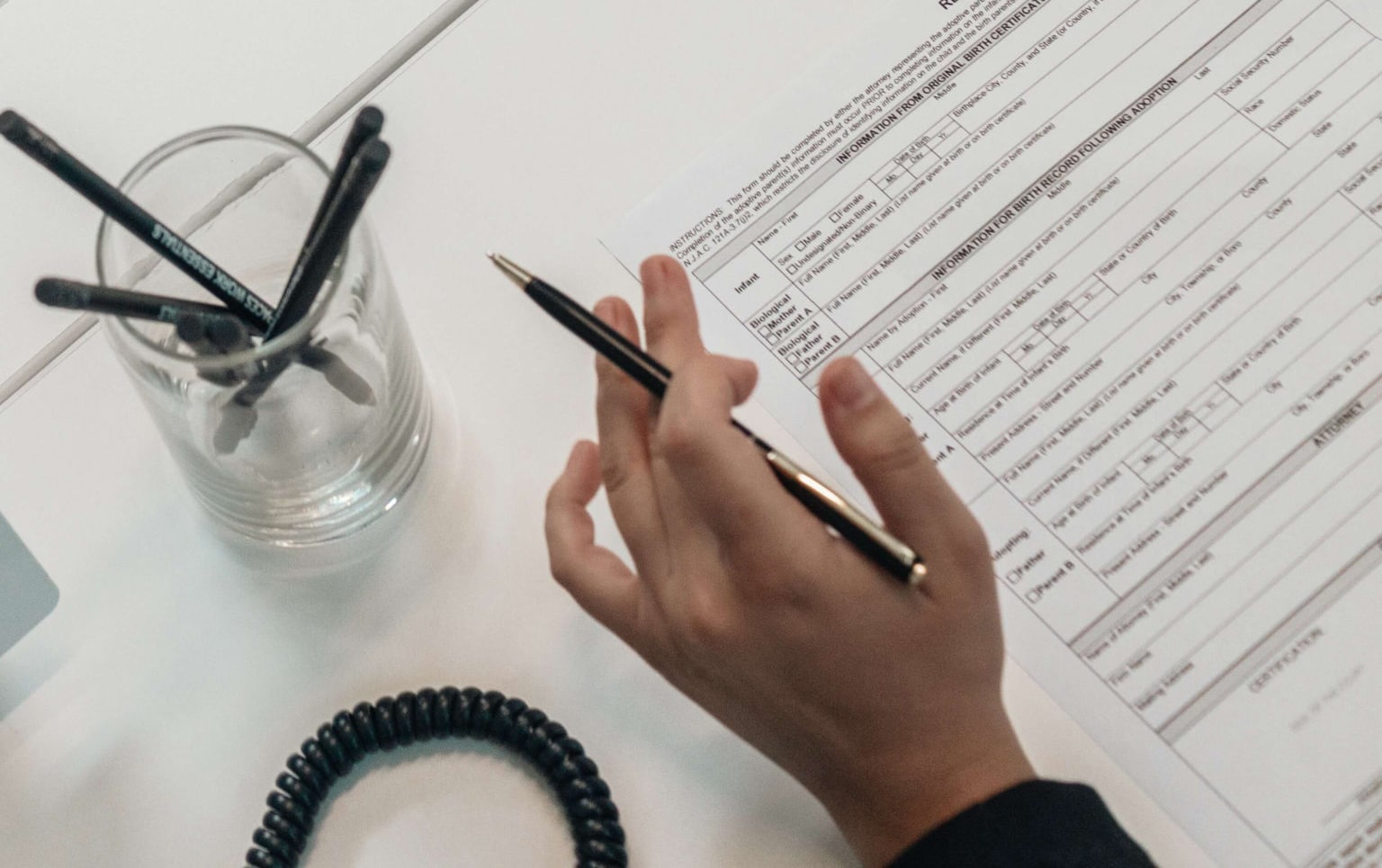

A gift is generally defined as a voluntary and gratuitous transfer of property, without any consideration given in exchange. A personal gift made in Canada may or may not be made on a tax-free basis, depending on the nature of the relationship between parties. A deed of gift can...

Change in Use of Principal Residence, Principal Residence Exemption and Subsection 45(2) Election When there is a change in use of your principal residence, a deemed disposition occurs under subsection 45(1) of the Income Tax Act. The Canadian Tax Act states that a taxpayer will be deemed to have...

Filing Tax Returns -Starting Point in the Administration of Income Tax Law in Canada Generally speaking, the starting point regarding the administration of income tax law in Canada is subsection 150(1), which states that a taxpayer must prepare and file an income tax return for each tax year without...

Introduction – The Canada Emergency Wage Subsidy Many Canadian businesses have been impacted by the ongoing COVID-19 pandemic. While many businesses are experiencing financial hardship, some of them are unable to pay their employee’s wages. In response, the Government of Canada introduced the Canada Emergency Wage Subsidy (CEWS) in...