Toronto-Dominion Bank (TD Canada Trust) v. Canada, 2026 FCA 25 Introduction: Unpaid Payroll Deductions: A Hidden Risk for Creditors The Federal Court of Appeal’s decision in Toronto-Dominion Bank (TD Canada Trust) v. Canada addresses an important issue in Canadian...

Tax Problems And Disputes With CRA?

We help you and your organization deal with tax matters efficiently and effectively.

Live a life free from tax despair

Tax problems are difficult to handle on your own. We can help you avoid expensive repercussions, give you a competitive edge, and keep you informed about the tax changes that affect you.

CRA Income Tax Solutions you are looking for

Whether the CRA is after you or you might so fear,

we have got you covered

![]() Certified by the Law Society of Ontario as a Specialist in Taxation Law

Certified by the Law Society of Ontario as a Specialist in Taxation Law

TAX TIPS BY TOP TAX LAWYER IN CANADA

Latest Tax Happenings

The Income Tax Experts In Our Team

A perfect mix of experience and ability makes income tax issues a subject of ease

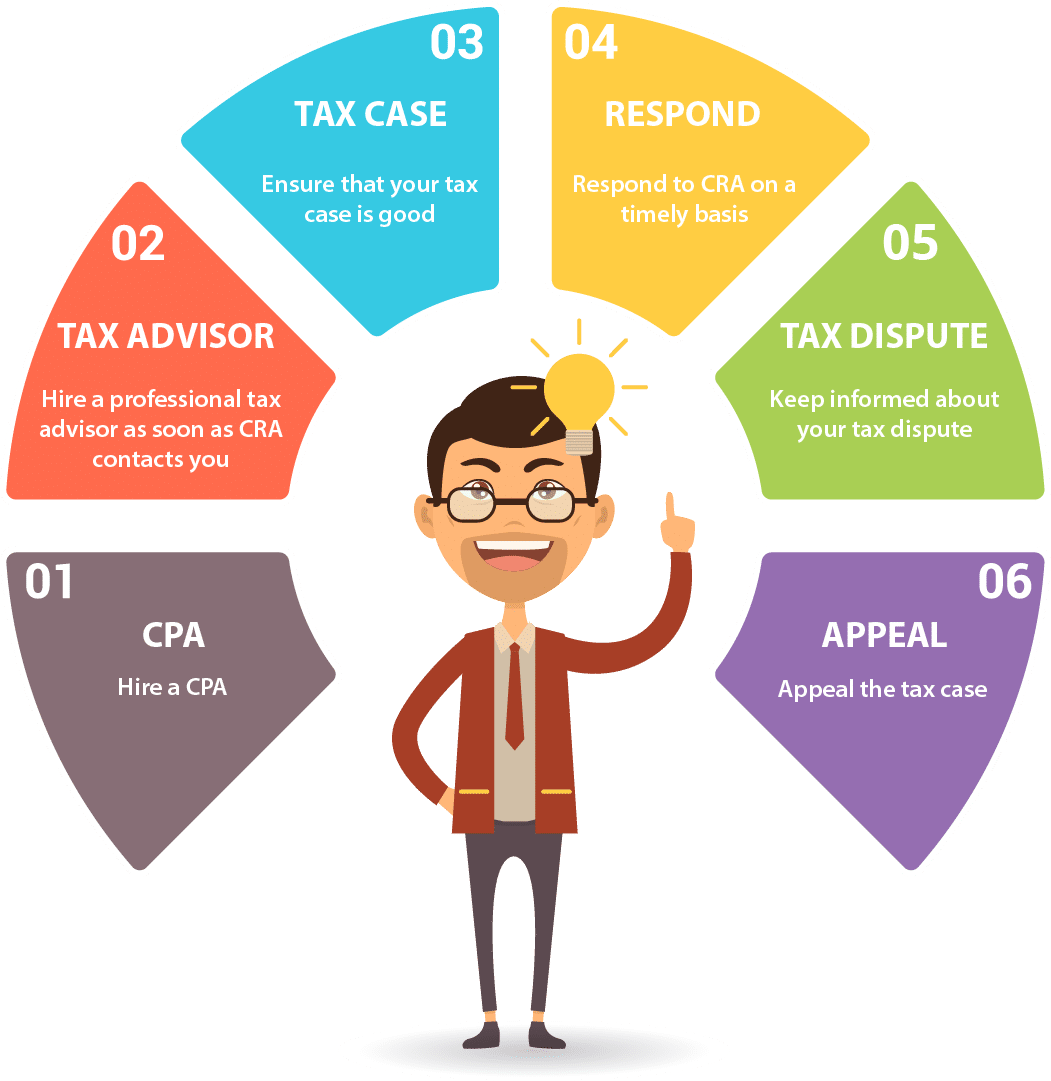

How to win An Income Tax Audit?

- Retain a Chartered Professional Accountant to prepare your books

- Hire a professional tax advisor as soon as CRA contacts you

- Ensure that your tax case is good

- Respond to CRA on a timely basis

- Keep informed about your tax dispute

- Appeal the tax case if you lose

News From our Blog

Some Latest Tax Stories

When a Canadian taxpayer tried to change his 2004 tax return, CRA declined and pushed for penalties plus interest while ignoring his change request for 10 years. Judicial review sided with the taxpayer. In 2005, anticipating that his 2004...

Introduction: Canadian Charity Law, CRA Revocation, and Constitutional Jurisdiction The British Columbia Supreme Court decision in Coram Deo Foundation v MNR, 2026 BCSC (S260171), is a significant Canadian charity law and Canadian tax litigation ruling addressing interim injunctive relief,...

In Insurance Institute of Ontario v. M.N.R., 2020 TCC 69, the Tax Court of Canada clarified that where a payor and a worker share a common intention regarding the nature of their relationship, that intention may prevail — even...

Introduction – Taxpayer Relief, Tax Reassessments, CPP Refunds, and the Jurisdictional Limits of Objection Rights In Tolley v. The King, 2026 TCC 14, the Tax Court of Canada examined whether a taxpayer can obtain an extension of time to...

What Our Clients are Saying?

I own Multimedia Lighting & Electric Ltd, an electrical contractor that specializes in large display signs. David Rotfleisch has been my tax and business lawyer and advisor since I started in business more than 15 years ago. He is great at planning to reduce my taxes and keeping me out of any trouble with CRA. His planning and advice is clever and to the point and I rely on him without hesitation.

I first met David Rotfleisch when he acted for the vendor of a business I bought, Richards-Wilcox, over 20 years ago. My partner and I were so impressed by him that once the deal was complete we retained him as our tax and business lawyer. He has acted for us on all tax and corporate matters since then, including the sale of our successful garage door business to Raynor in the US and has represented Raynor on the Canadian aspects of various transborder transactions. If you need a tax or business lawyer, David has a broad grasp of tax and business law and is helpful and responsive.

I own Hometown Electric, an electrical contractor that specializes in large display signs. David Rotfleisch has been my tax and business lawyer and advisor since I started in business more than 15 years ago. He is great at planning to reduce my taxes and keeping me out of any trouble with CRA. His planning and advice is clever and to the point and I rely on him without hesitation.

What Other Professionals are Saying?

I run a professional CPA practice with staff in Toronto, Canada and Texas, USA and have been dealing with David Rotfleisch’s tax law firm for over 15 years. David and I have worked on many different CRA and business files over the years, including voluntary disclosures, audits and appeals and the purchase and sale of businesses. He provides practical and timely tax and business advice. I refer all of my clients who need a Canadian business or tax lawyer to David.

I am a chartered professional accountant and a partner with the national accounting firm of Collins Barrow. I have worked with David Rotfleisch on hundreds of client files over the last 15 years. He is my most accessible tax lawyer and the one that I frequently go to, especially since he also has an accounting degree. He understands the accounting side of the issues as well as the tax and business law considerations. He deals with tax problems in a direct and cost effective way. I strongly recommend him to anyone in need of a Canadian tax lawyer.

I am a long time professional bookkeeper. From time to time my clients need a Canadian tax or business lawyer for will or tax planning or have problems with CRA and have to file a Notice of Objection or Appeal to Tax Court, or have unfiled income tax returns and have to submit a Voluntary Disclosure. I have been working exclusively with David Rotfleisch’s tax law Canada firm for over 5 years. He and his staff are knowledgeable in tax and corporate matters, responsive, effective and provide cost effective tax solutions. I continue to refer clients to him and would recommend him to anyone who has need of his services.

Subscribe to Newsletter

Get the latest income tax news from us.

FAQ

What type of cra tax problems does taxlawcanada cover?

Rotfleisch and Samulovitch P.C. covers a wide range of CRA tax issues, including: net worth audits, voluntary disclosures, tax audits, business startup planning and more. Contact us today to see how we can assist with your tax issue or dispute.

Who should I contact when having tax problems?

It’s recommended that you contact a tax lawyer immediately to evaluate your options. Click here to get in touch with Rotfleisch and Samulovitch P.C.