Introduction: Cryptocurrency-Trading Businesses in Canada Canadian cryptocurrency-trading businesses face unique challenges. The mostly unregulated market brings higher risk of fraud and cyber-crime. The volatile markets may bleed profits. And some cryptocurrency traders don’t even realize that they’re carrying on a business, misreporting their profits as capital gains. This article...

Introduction – Indirect Tax Audit Methods Canada’s income tax system is designed around every taxpayer, individual, corporation or trust, filing an annual return which reports all of the income that taxpayer earned during the year. Similarly, GST/HST is administered by requiring suppliers of goods and services to regularly file...

Money transferred from a corporation to its shareholder was reassessed as shareholder benefits This case was a split decision with the taxpayer’s Canadian tax lawyer winning the argument against gross negligence penalties but losing with respect to statute barred years. Mr. Deyab and his spouse carried out engineering consulting...

Introduction – Tax Search Warrants Canada’s federal Income Tax Act includes provisions that grant the Canada Revenue Agency (the “CRA”) a wide range of powers for administering and enforcing the Act. For instance, section 231.1 grants the CRA the power to tax audit and inspect the books and records...

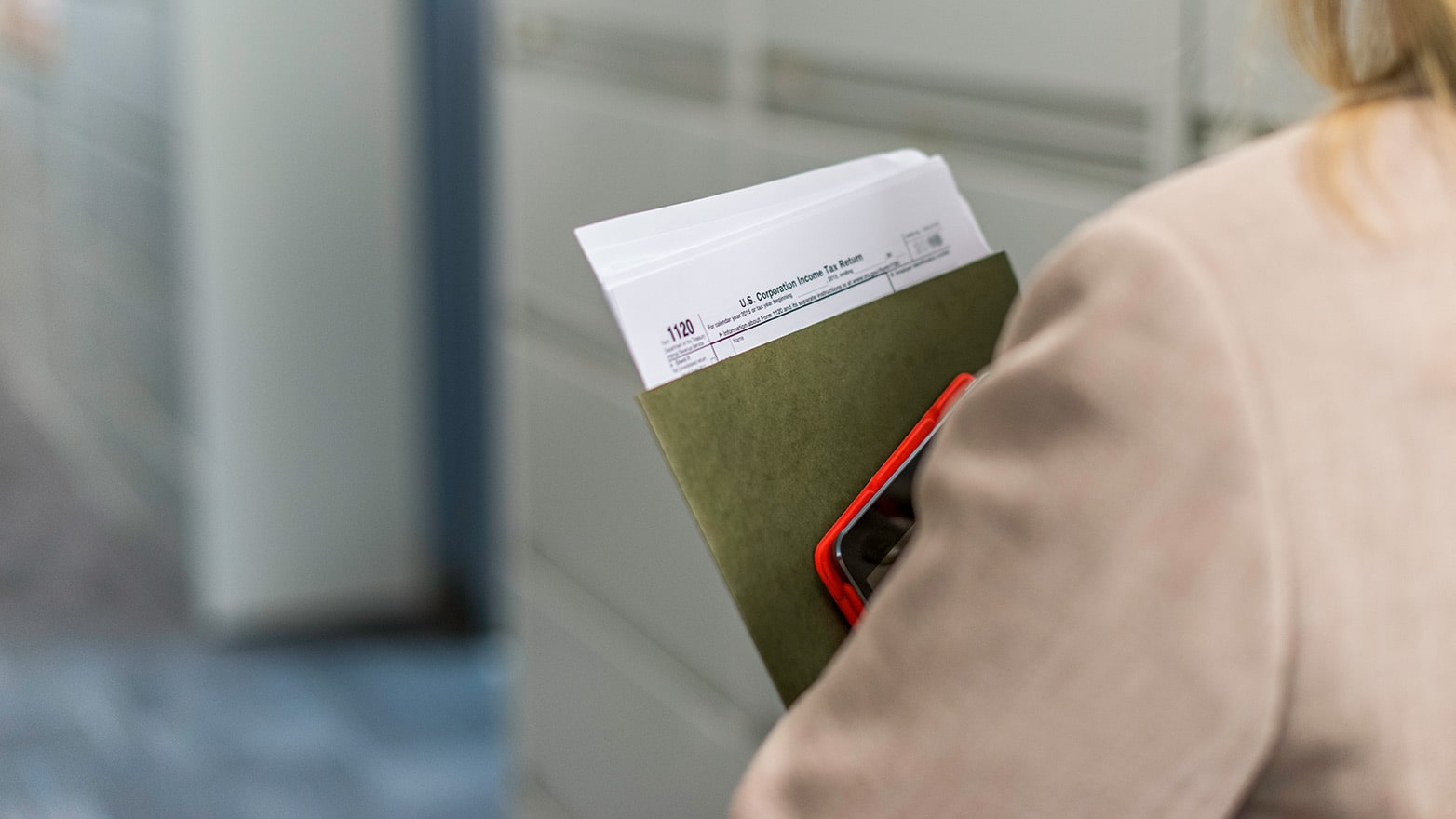

Introduction – Business Tax Audit Business tax audits are a keyway by which the Canada Revenue Agency (CRA) ensures that a business has fulfilled its tax obligations with respect to income tax, payroll deductions, benefits, remittances, and GST/HST, pursuant to the Income Tax Act and the Excise Tax Act....

If you are curious about using a shareholder loan and want to know the potential fallout that it could have for you in terms of taxes in Canada, it is important to educate yourself about these issues well in advance of facing a problem. What Is A Shareholder Loan?...

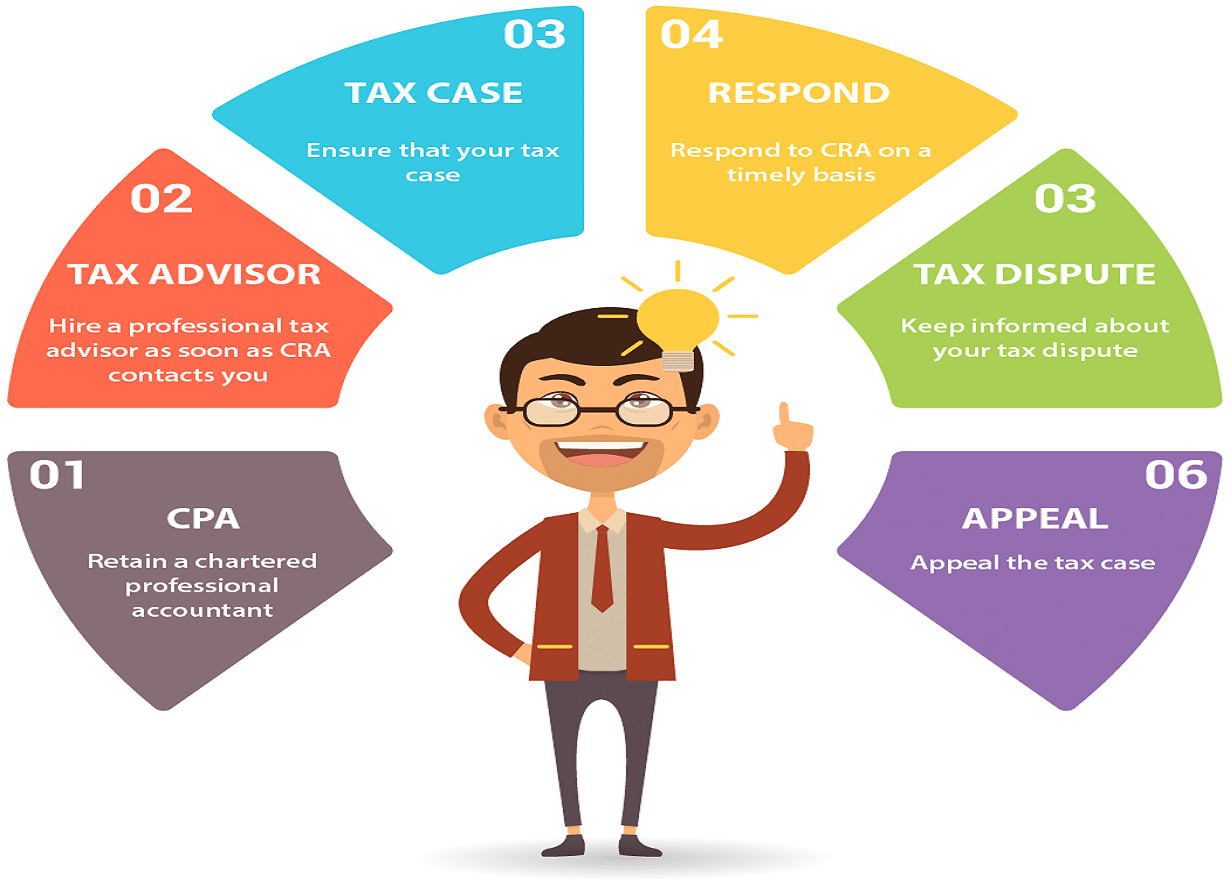

Tackling tax problems is difficult enough and to add to that if you are dealing with CRA auditors or CRA tax collectors, professional representation from our team of the best Canadian tax lawyers is an absolute necessity. CRA’s tax auditors and tax collectors not only have different functions but...

We are a specialized Canadian tax law firm with 30 years of experience and have seen it all, so our experience tells us that nothing creates as much fear, confusion and stress as a tax audit. Starting from business owners who contact us less than one week before a...

Any problem related to tax and tax audit is difficult and stressful to manage on your own .In the Canadian income tax system it is up to every taxpayer to properly report their annual income on their income tax return, since the Canadian tax system is based on “self...