Tax planning is very difficult and stressful to handle on your own and it is not at all easy to achieve the tax planning technique which perfectly fits the case at the first go, so in case of tax errors a rectification order provides a safety net for taxpayers...

Tax law is complex and it is unwise to proceed without proper guidance. The extensive powers granted by the Canadian Income Tax Act to the CRA to collect tax creates additional problems, thus certain limitations are imposed on the CRA Collection abilities. These limitations specify that the CRA does...

Even before a tax debtor has time to react or engage a tax expert his bank accounts can be seized and money taken without a court order. This is because the Canadian Income Tax Act grants extensive powers to the CRA collection officers which often leave the Canadian tax...

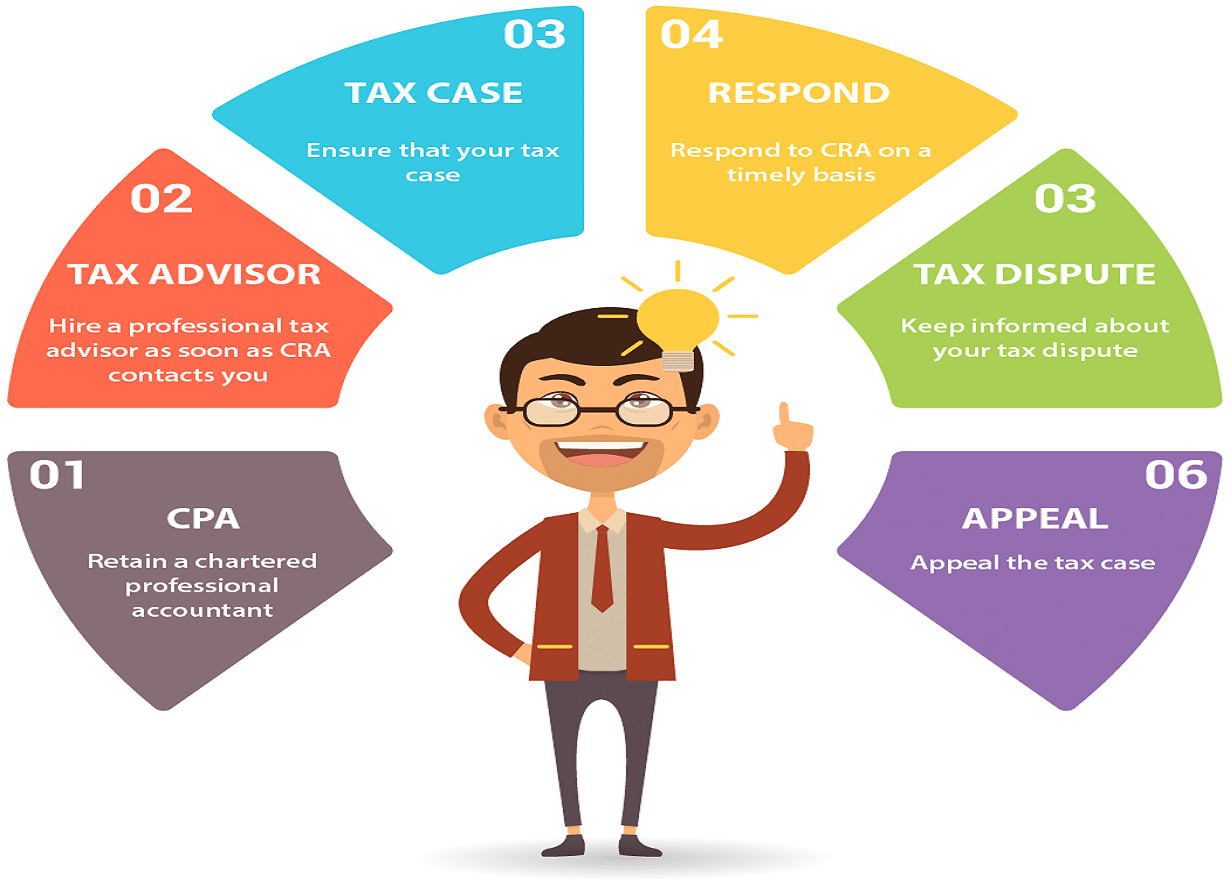

Tackling tax problems is difficult enough and to add to that if you are dealing with CRA auditors or CRA tax collectors, professional representation from our team of the best Canadian tax lawyers is an absolute necessity. CRA’s tax auditors and tax collectors not only have different functions but...

Tax evasion is an offence under the Income Tax Act and the Excise Tax Act (for GST/HST) but notably it is not a criminal code offence. Over the years CRA has come up with many policies to actively deter Canadian taxpayers from tax evasion but the new policy of...

We are a specialized Canadian tax law firm with 30 years of experience and have seen it all, so our experience tells us that nothing creates as much fear, confusion and stress as a tax audit. Starting from business owners who contact us less than one week before a...

Any problem related to tax and tax audit is difficult and stressful to manage on your own .In the Canadian income tax system it is up to every taxpayer to properly report their annual income on their income tax return, since the Canadian tax system is based on “self...

Canada’s Tax Act gives sweeping powers to the Canada Revenue Agency and by extension its tax collection officers, to collect the tax debts of taxpayers. In many cases, taxpayers are taken by surprise when their bank accounts are frozen, assets liened or seized and wages garnisheed. When a taxpayer...